Protect Against A PSP Shutdown

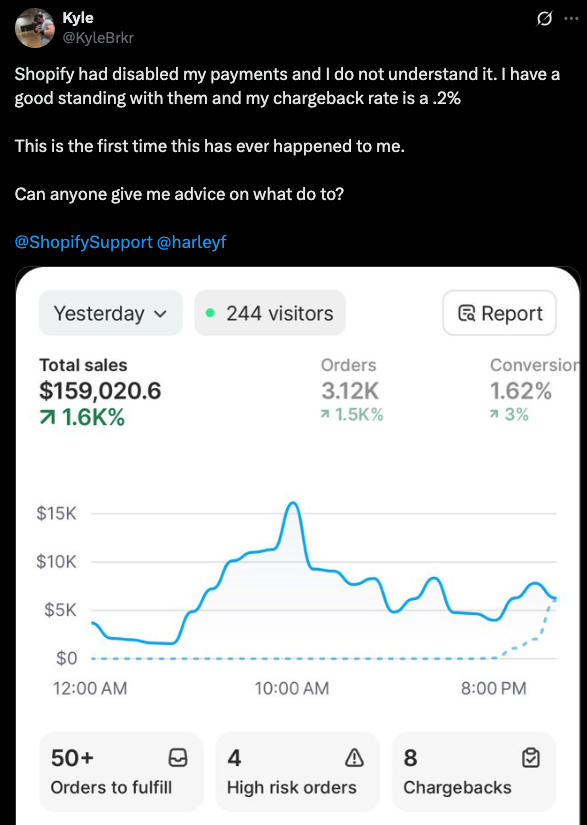

Nearly 70%* of the high-risk merchants working with Stripe or Shopify don't realize the severity of being shut down without warning.

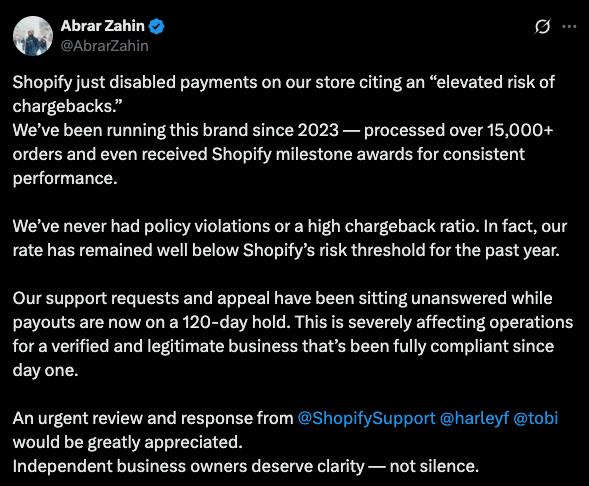

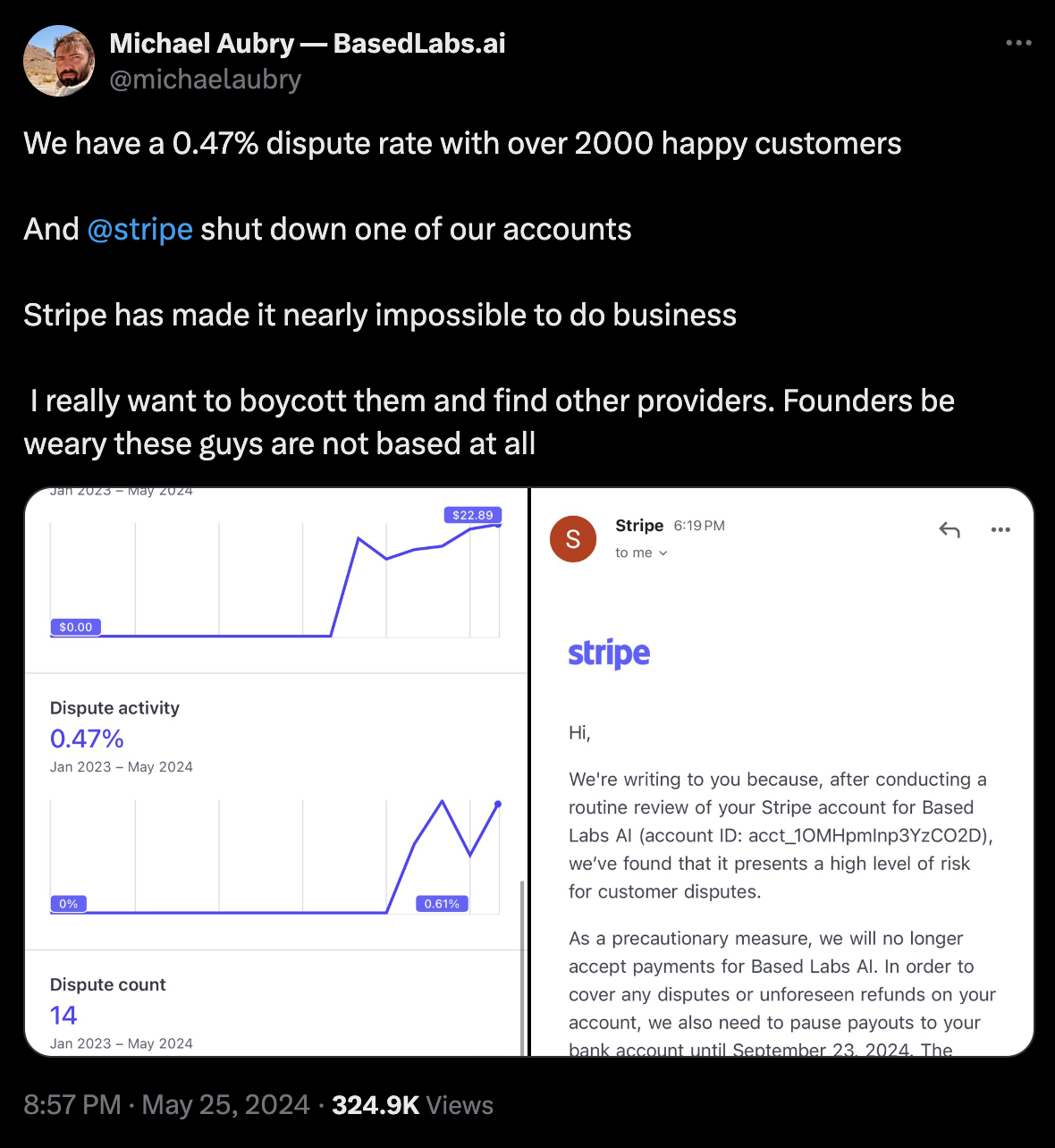

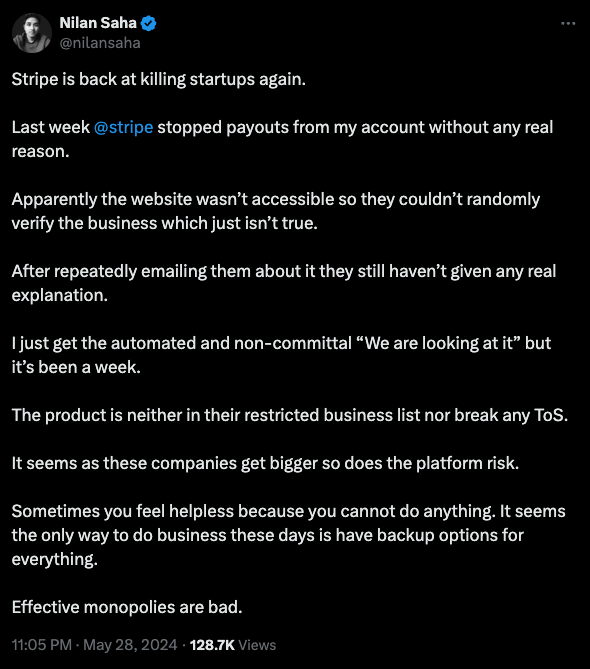

Hear from two merchants who were shut down by Stripe for being "high risk" and what they did to begin transacting again.

Read: A Tale of Two Merchants >

High-Risk Merchants are Always at Risk of Shutdown

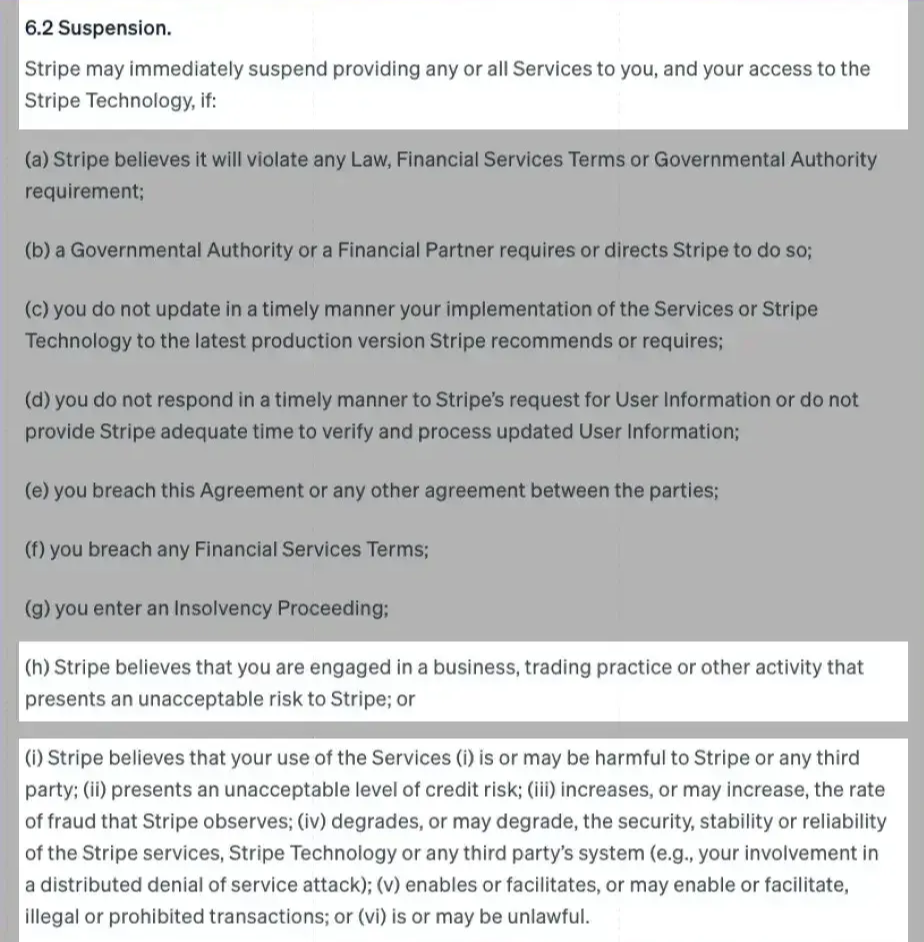

The Stripe Services Agreement states in sections 6.1 and 6.2 that your account could be shut down without warning for reasons such as:

- Higher than anticipated chargeback rates

- Concerning rates of suspicious activity

- “Bad actor” reports of the account

- Operating in “high-risk” industries like gambling, gaming, dating, CBD, and e-commerce

If an account has already been deemed “high-risk” and has issues with chargeback rates, suspicious activity, or fraud reports, the account could be shut down until further review.

Once an account is flagged for review, it is unlikely any amount of appeals will get operations moving again and a Stripe alternative would be needed to process payments.

Who is Classified as a High-Risk Merchant?

While Stripe, Shopify, and their financial institutional partners do have a restricted business list, the reality is that who is classified as a high-risk merchant varies from region to region.

A merchant can be labeled as “restricted” or “high-risk” at any point during a relationship with PSPs. A certain amount of chargebacks can trigger a review or even a “false flag” can get an account frozen.

Visa uses a tiered system called the Visa Acquirer Monitoring Program (VAMP) and Merchant Category Codes to designate high-risk businesses. Falling into any one of these tiers puts your business at increased risk of being shut down by Stripe or Shopify, even if your industry isn't highly regulated.

This means merchants in crypto, CBD, free trial subscriptions, games of skill, gambling, dating, travel, digital health, and more could be designated as high-risk. While Stripe support will help some merchants find success, many will not. A merchant must go through many hoops to begin transacting again.

"Our PSP said they were okay with our business but they ended up going back on their word and shutting us off without any warning. We wanted to make sure that we're always in a position where we will have a provider even if something happens."

How Basis Theory Helps

Peace of Mind and Options

Basis Theory removes PCI compliance scope for a high-risk merchant. Collect payment data, tokenize and store it in your cardholder data environment (CDE) hosted by Basis Theory.

This removes most of the burden of maintaining PCI compliance and provides freedom through network-agnostic tokens that high-risk merchants can use as part of a Stripe alternative, partner, or network.

Owning this data means building dynamic routing to reduce payment risks when processing. Then, if your PSP creates any issue, you have alternatives.

Create Tailored Payment Experiences

A Fully Programmable Vault

Create commerce flows, manage compliance, and keep control of payments data with Basis Theory. This allows you to:

- Reduce exposure to PSP outages and shutdowns

- Work with any payment partners you choose

- Maintain complete control of payment flows

Easily Connect with Your Current PSP

A flexible API that connects with any existing payment service provider you choose, including Stripe.

Related Resources

What is a High-Risk Merchant?

Learn more about what it means to be a high-risk merchant and how this impacts payment processing.

What Are High-Risk Payment Processors?

Certain merchants must use specially designated PSPs that specialize in their business.

What High-Performance Merchants Should Know

Everything high-risk merchants needs to know about payments, compliance, disputes, and risks.

Start Today

Speak with one of our payments experts to help you keep your high-risk business running.

Speak with Our Payments Experts

*based on an anonymous survey of 100 merchants operating in high-risk industries.

.png?width=150&height=50&name=BTLogo%20(1).png)